accumulated earnings tax calculation example

Future Value - FV. During 2011 and 2012 for example FICA tax revenue was insufficient to maintain Social Securitys solvency without transfers from.

Taxable Income Formula Examples How To Calculate Taxable Income

Thought to have.

. 21 Throughout this Chapter the following terms have the meanings indicated below. As long as contributions are within the contribution limits none. In California these supplemental wages are taxed at a flat.

And interest dividend and retirement statements. 23 In addition to reviewing the Schedule M-2 Analysis of Unappropriated Retained Earnings per Books from a corporations annual Form 1120 a detailed analysis of. And by the compounded investment earnings of the accumulated totals.

After receiving all your wage and earnings statements Forms W-2 W-2G 1099-R 1099-MISC 1099-NEC etc. 6 to 30 characters long. ASCII characters only characters found on a standard US keyboard.

Corporations are required to pay a 20 accumulated earnings tax if the company doesnt pay dividends or distribute-this is on top of regular corporate tax. The future value FV is the value of a current asset at a specified date in the future based on an assumed rate of growth over time. Provincial or territorial labour-sponsored funds tax credit.

California has the highest top marginal income tax rate in the country. A corporation can accumulate its earnings for a possible expansion or other bona fide business reasons. Example 2amount of insolvency less than canceled debt.

Subtract the total tax rate from number one to find the net percent. Earnings before tax EBT. If you already have a project use the drop-down to select a project.

Open Google Developers Console. Apple Effective Tax Rate Example Calculation. Compound interest includes interest earned on the interest that was previously accumulated.

In 2021 your IRA contribution limit is 6000. A reference to employment includes an office and a reference to employee includes an officer. Tax on earnings on nondeductible contributions.

Or b the lesser of i 250 for each employee who is not a highly compensated employee. Double Declining Balance Depreciation Method. Effective Tax Rate Taxes Paid Pre-Tax Income.

Funded by FICA taxes. 02965 1 - Total Tax Rate Net Percent 1. The latest Lifestyle Daily Life news tips opinion and advice from The Sydney Morning Herald covering life and relationships beauty fashion health wellbeing.

Unemployment compensation statements by mail or in a digital format or other government payment statements Form 1099-G. Terms used in this Chapter. Accumulated federal and provincial or territorial tax deductions if any to the end of the last pay period.

At the end of year 1 it had 100 of accumulated earnings 40 of which will be paid as a dividend. If you qualify your gross rental income from your rental real estate activity is treated as though derived in the ordinary course of a trade or business and isnt. The double declining balance depreciation method is one of two common methods a business uses to account for the expense of a long-lived asset.

Effective Tax Rate Formula. If you dont have a project listed or want to create a new one click Create project. In this example an employee got a retroactive pay increase from 1000 to 1100 per week that applies to 25 weeks.

Using the Bardahl formula X estimated it will cost 25 cash to complete an operating cycle. Must contain at least 4 different symbols. Similar to the provisions of a Roth IRA these contributions are made on an after-tax basis.

The formula to calculate the effective tax rate is as follows. The credit equals 50 of qualified startup costs up to the greater of a 500. Payments for non-deductible moving expenses often called a relocation bonus severance and pay for accumulated sick leave.

Because the AIME and the PIA calculation incorporate the AWI Social Security benefits are said to be wage indexed. However because of your filing status and AGI the limit on the amount you can deduct is 3500. A reference to an RRSP includes an individuals account under a specified pension plan SPP or a pooled registered pension plan PRPP.

However only the distributions made from current or accumulated EP will reduce EP. Generally the E. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines.

For accumulated after-tax contributions and earnings in a designated Roth account Roth 401k qualified distributions can be made tax-free. However if a corporation allows earnings to accumulate beyond the reasonable needs of the business it may be subject to. Create a service account.

Example for year-to-date bonus calculation method. Divide the net payment you want to get to by the net percent Flat Rate Social Security Rate Medicare Rate Total Tax Rate 22 percent 62 percent 145 percent 2965 percent converted to a decimal. Regarding the taxes on your salary youll pay federal income tax and employment tax.

You can make a nondeductible contribution of 2500 6000 3500. Follow the on-screen instructions and select Create. Participated in a rental real estate activity for more than 500 hours in any 5 tax years whether or not consecutive during the 10 tax years immediately prior to this tax year.

Beginning in the 2006 tax year employees have been allowed to designate contributions as a Roth 401k deferral. In its budget X set aside 35 of cash to finance acquisitions it is actively investigating. A foreign corporations current EP is an annual calculation with accumulated EP generally being the sum of prior-year calculations with necessary adjustments eg reduction for dividends.

The annual calculation of a foreign corporations EP is generally based on a three-step approach see Regs. The effective tax rate can be calculated for historical periods by dividing the taxes paid by the pre-tax income ie. Compare for example a bond paying 6 percent semiannually that is coupons of 3 percent twice a year with a certificate of deposit that pays 6 percent interest once a yearThe total interest payment is 6 per 100 par value in both cases but the holder of the semiannual bond receives.

Select the Menu icon Permissions Service accounts Create service account. For tax years beginning after December 31 2019 eligible employers can claim a tax credit for the first credit year and each of the 2 tax years immediately following. The accumulated earnings tax does not apply to.

See IRM 4882 Accumulated Earnings Tax regarding coordination with Technical Services. Its a high-tax state in general which affects the paychecks Californians earn. This lets us find the most appropriate writer for any type of assignment.

X has been a profitable business for several years. IRC 534b requires that taxpayers be notified if a proposed notice of deficiency includes an amount with respect to the accumulated earnings tax imposed by IRC 531 so that the burden of proof initially will be on a taxpayer. Compound interest or compounding interest is interest calculated on the initial principal and also on the accumulated interest of previous periods of a deposit or loan.

Bardahl Formula Calculator Defend Against Accumulated Earnings Tax

Demystifying Irc Section 965 Math The Cpa Journal

Overview Of Improperly Accumulated Earnings Tax In The Philippines Tax And Accounting Center Inc

Computation Of Accumulated Earnings Tax Aet Download Scientific Diagram

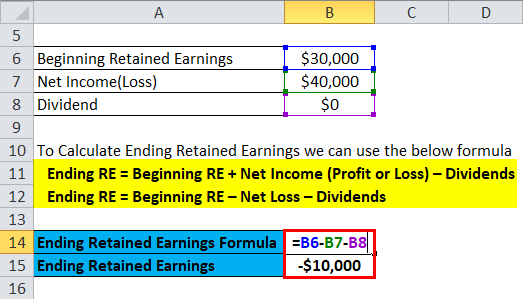

Retained Earnings Formula Calculator Excel Template

Earnings And Profits How To Calculate Them

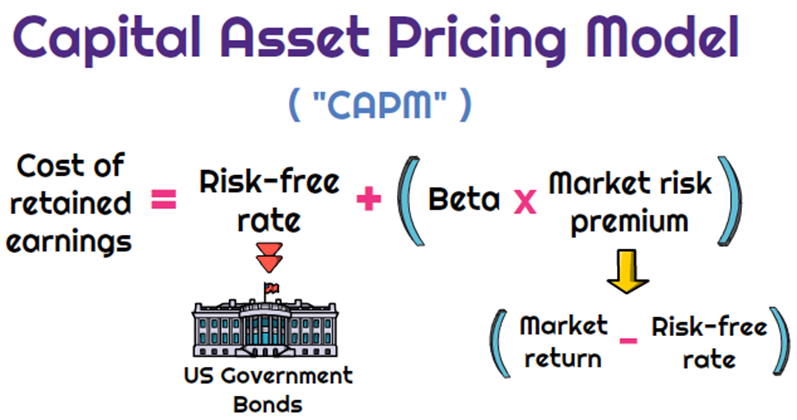

Methods To Calculating The Cost Of Retained Earnings Or Common Equity Universal Cpa Review

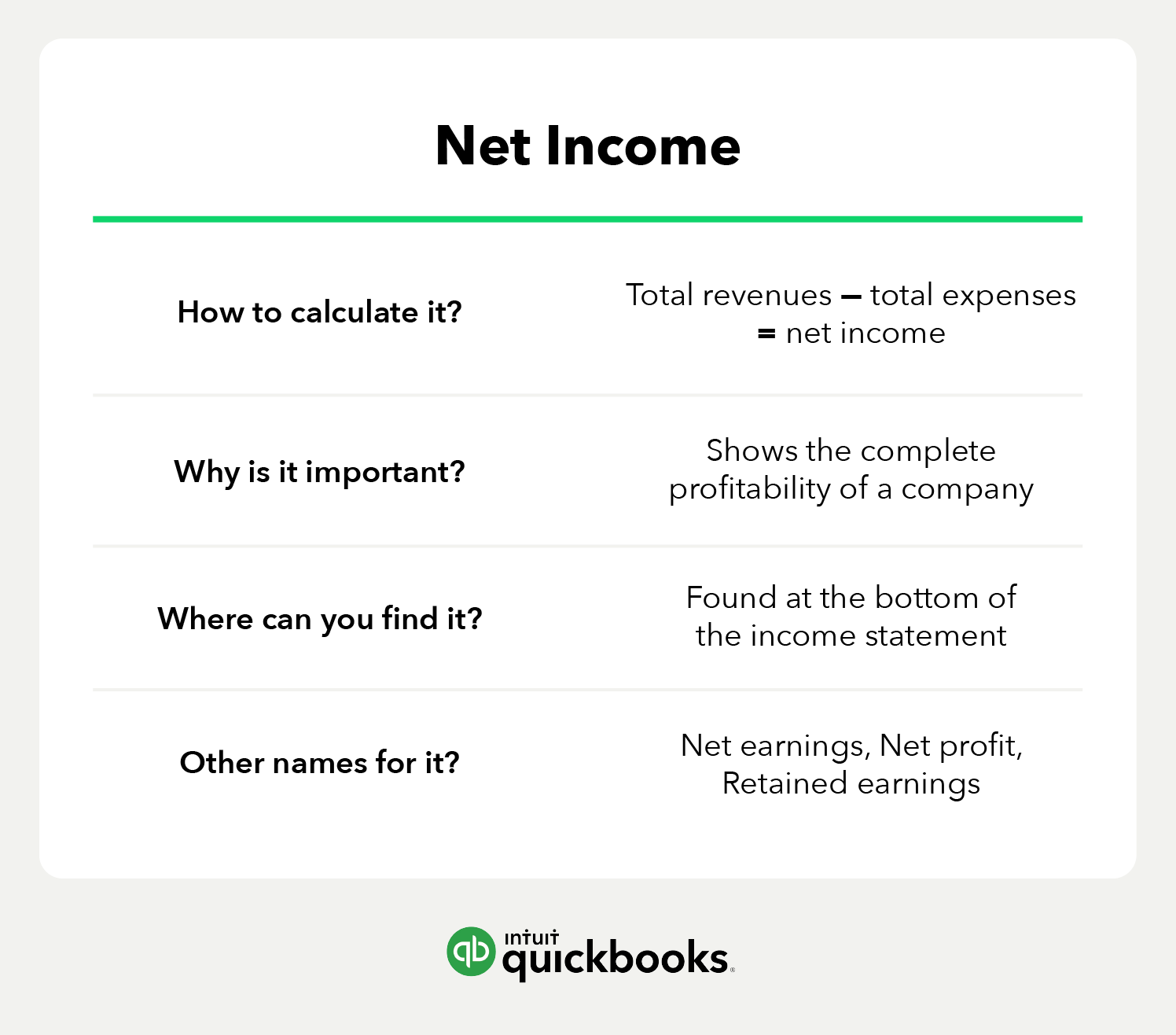

What Is Net Income Formula Calculations And Examples Article

/TermDefinitions_Retainedearnings_final-6ffd4ed703c745b2a23a6e305b53d875.png)

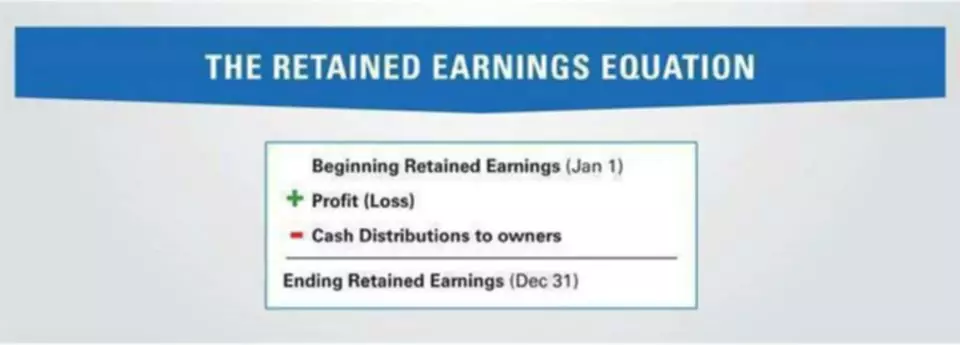

Retained Earnings In Accounting And What They Can Tell You

What Is The Accumulated Earnings Tax Kershaw Vititoe Jedinak Plc

Retained Earnings Re Financial Edge

Solved Please Refer To The Attachment To Answer This Question This Course Hero

Retained Earnings Formula Youtube

Accumulated Deficit Formula And Calculator Step By Step

What Are Retained Earnings Definition And Explanation Bookstime

How To Complete Form 1120s Schedule K 1 With Sample

Are Retained Earnings Taxed For Small Businesses

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

What Are Retained Earnings How To Calculate Retained Earnings Mageplaza